Table of Contents

ToggleNew GST Rule 2023: The Goods and Services Tax (GST) Department has announced a new limit for businesses under which all businesses with an annual turnover of more than Rs. 5 crores will be required to generate e-invoices for their transactions. Here are all the details.

All GST taxpayers whose aggregate annual turnover exceeds Rs 5 crore in any financial year will have to mandatorily generate e-invoices for business-to-business (B2B) supply of goods and or services or for exports, starting August 1, Tuesday. Earlier, companies with an annual revenue of Rs 10 crore or above were only required to generate e-invoices.

Understanding GST e-invoicing

The Goods and Services Tax or GST e-invoice has been made mandatory to prevent tax evasion and allow an invoicing standard in the country. It is a system in which business-to-business (B2B) invoices and a few other documents are authenticated electronically by the Goods and Services Tax Network (GSTN) for further use on the common GST portal, according to Cleartax.

The main purpose of GST invoicing is to electronically validate all B2B transactions and pre-populate the relevant information into the GST forms of taxpayers.

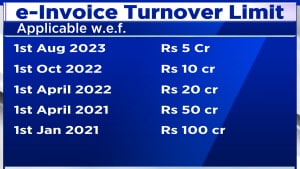

A look at reducing thresholds for e-invoice turnover limits

Who should raise the GST e-invoice?

The taxpayers must comply with e-invoicing in FY 2022-23 and onwards if their e-invoice limit or turnover exceeds the specified limit in any financial year from 2017-18 to 2021-22. Also, the aggregate turnover will include the turnover of all GSTINs under a single PAN across India, as per Cleartax

Which Businesses Are Exempted From E-invoicing (New GST Rule 2023)?

According to ClearTax, these categories are exempted from filing for e-invoice:

- “An insurer or a banking company or a financial institution, including an NBFC

- A Goods Transport Agency (GTA)

- A registered person supplying passenger transportation services

- A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services

- An SEZ unit (excluded via CBIC Notification No. 61/2020 – Central Tax)

- A government department and Local authority (excluded via CBIC Notification No. 23/2021 – Central Tax)

- Persons registered in terms of Rule 14 of CGST Rules (OIDAR)”

Benefits for MSME Sector:

- The inclusion of MSMEs in the e-invoicing regime is seen as a positive step that can boost the sector’s growth.

- Experts believe that the expansion of e-invoicing to MSMEs will improve the flow of input tax credit and reduce credit-related issues for suppliers.

- Phased implementation of e-invoicing has helped in reducing disruptions, improving compliances, and increasing revenue.

- The move is expected to benefit the overall business ecosystem by reducing costs, minimizing errors, ensuring faster invoice processing, and limiting commercial disputes in the long run.

Government’s Focus on Raising Revenue and Tackling Tax Evasion:

- The reduction in the threshold limit for e-invoicing is expected to help the GST department in raising additional revenue and curbing tax evasion.

- The government is leveraging robust data analytics and artificial intelligence to identify and track risky taxpayers.

- Data sharing with partner law enforcement agencies enables a more targeted intervention in addressing tax evasion effectively.